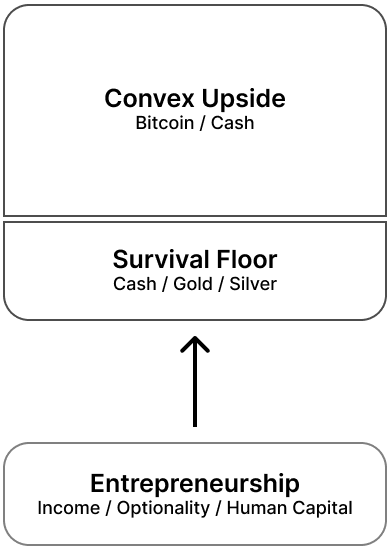

Survival Floor Convex Upside Portfolio

A survival-first capital system that compounds asymmetrically in non-ergodic reality.

By: Craig Anthony, CFA

Preamble

This framework draws on two decades in high-net-worth portfolio management, derivatives, and independent capital allocation, grounded in first-principles thinking about money. It is designed for individuals optimizing for survival, convexity, and resilience, with robustness to centralized failure as a core constraint.

Regimes break. Smooth distributions lie. Proceed accordingly.

Overview

A portfolio designed to be maximally right and never wrong.

Right: Minimize permanent impairment of purchasing power. Maximize long-term growth. Preserve mobility, physicality, and resilience across infrastructure states, including extreme failure.

Wrong: Optimize for expected return, volatility minimization, Sharpe ratio, or correlation.

The Portfolio and Rationale

This portfolio is structured by resolving two fundamental tensions that all capital allocation must confront: survival versus growth, and certainty versus optionality.

Survival requires certainty: assets that remain functional under stress, preserve purchasing power, and prevent forced action. Growth requires optionality: exposure to volatility, concentration, and asymmetric outcomes that compound over time. Attempting to optimize both within a single pool of capital produces fragility. Assets chosen for stability suppress upside; assets chosen for growth introduce unacceptable risk of permanent impairment.

These properties cannot be simultaneously maximized.

Because these tensions are structural, not philosophical, they cannot be resolved through diversification, optimization, or forecasting. They must be resolved architecturally.

For this reason, the portfolio is decomposed into three distinct layers, each optimized for a single, non-negotiable role:

- The Survival Floor: prevents ruin and forced action

- The Convex Upside: captures long-term asymmetric growth

- Entrepreneurial activity: feeds the system externally without introducing fragility

This structure is intentionally barbell-like. Convex Upside is the growth engine. The Survival Floor is the anti-ruin base. There is no intermediate layer balancing risk and return. Assets between these roles dilute convexity without improving survivability and are excluded.

This is not a diversified portfolio in the conventional sense. It is a ruin-resistant, convex system optimized for two outcomes only: avoiding permanent impairment and maximizing long-term growth. Every component must justify itself on one of those axes. If it cannot, it is noise.

Infrastructure States

Portfolio design is incomplete without specifying the environments it must function in. This framework explicitly accounts for distinct infrastructure states under which financial systems, payment rails, and custody assumptions change.

The portfolio is designed to remain viable across the following states:

State A — Normal Conditions:

Power, internet, and markets function. Institutions operate. Rule of law holds.

State B — Partial Disruption:

Power and internet remain available, though potentially stressed. Financial systems degrade: banks restrict withdrawals, governments interfere with money or markets, counterparties fail.

State C — Severe but Temporary Breakdown:

Regional or multi-regional grid and network outages persist for weeks or months. Markets and exchanges are non-functional. Social order is stressed but intact.

State D — Permanent Civilizational Breakdown:

Global, long-term loss of industrial and financial infrastructure with no reasonable recovery path, implying reversion to pre-modern conditions.

These states are not predictions. They are design constraints. The portfolio is built to remain functional across States A through C. State D is a boundary condition, not an investable scenario, included to clarify the system's limits.

Portfolio Components

With the constraints defined, the portfolio can be described by its functional components. Each solves a specific problem. None substitutes for the others.

Convex Upside (Growth Engine)

The Convex Upside layer captures asymmetric long-term growth. Volatility and concentration are accepted here in exchange for open-ended payoff and durability. This layer is unconcerned with short-term drawdowns.

Survival Floor (Invariant Base)

The Survival Floor eliminates permanent impairment and forced action. It remains functional across infrastructure states, including severe disruption. It prioritizes liquidity, physicality, and resilience over optimization. It is stored, untouched, and forgotten. It absorbs volatility and buys time.

Entrepreneurship (External Engine)

Entrepreneurship is an external engine that feeds the system without introducing fragility. It is not an asset class but a source of human capital convexity.

Convex Upside: Asset Selection and Allocation

With the portfolio architecture fixed, the Convex Upside layer can be populated. This layer exists for a single purpose: to maximize long-term asymmetric growth. It is unconcerned with short-term volatility or drawdowns. Its only mandate is exposure to convex payoff that compounds without counterparty risk.

Because convexity is rare, this layer is intentionally sparse.

Bitcoin

Allocation: 95% of non-Survival Floor wealth, held in self-custody cold storage.

Bitcoin is the sole asset in the Convex Upside layer because it uniquely satisfies the requirements of durable convexity. It combines asymmetric payoff, a non-linear adoption curve, global liquidity, and the absence of counterparty risk in a way no other asset does.

Bitcoin is a long-dated call option on a new monetary regime. Its payoff does not depend on productivity, earnings, or cash flows. Its upside emerges from global adoption, monetary repricing, and network utility. These dynamics create a convex payoff profile that strengthens with time rather than decays.

Several properties make Bitcoin uniquely suitable:

- Asymmetric payoff: Downside bounded; upside unbounded.

- Non-linear adoption: Value accrues through network effects.

- Global optionality: Held, transferred, or exited across jurisdictions.

- No counterparty risk: Self-custody eliminates institutional dependence.

- Scalability: Scales with wealth without operational complexity.

This convexity thesis is a high-conviction bet on network effects outrunning path-dependent risks like regulatory or technological threats.

Concentration is not a flaw; it is a requirement. Convexity diluted across assets ceases to be convex. Diversification here reduces exposure to the outcome the layer exists to capture.

Bitcoin absorbs upside, outruns monetary debasement, and monetizes adoption. It is optimized for long-term asymmetric growth, not comfort, predictability, or smooth returns.

Unlike options, whose convexity decays with time and depends on path, liquidity, and timing, Bitcoin's convexity strengthens with duration and requires no renewal.

A practical consequence: once Bitcoin is understood (genuinely understood, which may take hundreds of hours), it requires no active management. Excess attention adds no value. The optimal behavior is ownership, patience, and focus elsewhere.

Cash

Allocation: 5% of non-Survival Floor wealth.

Cash here preserves local optionality, not safety. This cash is not part of the Survival Floor and is not intended to hedge risk, smooth volatility, or generate yield.

Its purpose is narrow: seize rare opportunities, handle timing mismatches, avoid forced action within the layer.

This cash is ephemeral. Excess flows into Bitcoin. It exists to enable flexibility, not to accumulate.

Survival Floor: Composition and Sizing

The Survival Floor eliminates permanent impairment and forced action. It remains functional across infrastructure stress, preserves decision-making autonomy, and ensures continued participation regardless of conditions. It is not optimized for returns.

This layer is invariant. Constructed, stored, untouched. Its value is measured by the absence of catastrophe.

Survival Floor sizing is personal and family-specific, scaling with obligations, jurisdictions, lifestyle, and new dependencies rather than as a fixed percentage of net worth.

Cash

Allocation: $200,000 in physical cash, held in self-custody.

Cash provides immediate liquidity during local chaos. It is inferior as a long-term store of value but superior when speed, flexibility, and certainty matter.

It is a lubricant: absorbing volatility, preventing forced liquidation of convex assets, buying decision time when institutions fail.

This allocation is sized to provide:

- Multi-year runway during partial system failure

- Insulation from bank holidays, capital controls, and freezes

- Freedom from selling Bitcoin under stress

Its function is singular: buy time.

Gold

Allocation: 20 ounces of physical gold, held in self-custody.

Breakdown: 14 × 1 oz coins, 7 × ½ oz coins, 7 × ¼ oz coins, 7 × 1/10 oz coins. No bars.

Gold is off-grid value and emergency transactability. Anti-ruin, not liquidity. Universally recognized, physically durable, cognitively simple.

Gold's role is deliberately narrow. It does not hedge Bitcoin's long-term failure. It hedges Bitcoin's temporary illiquidity during severe but finite disruptions. This is a much smaller role than gold is commonly assigned.

We do not ask gold to grow, compound, or keep pace with Bitcoin. We ask it only to exist physically and prevent catastrophe.

Gold should not be overweighted because it feels safe. Rational allocation is capped by:

- Probability of State C or worse

- Cost of lost optionality if Bitcoin is temporarily inaccessible

- Need for local, high-value physical settlement

An ounce-based floor beats a dollar-based floor. Dollars are nominal, inflation-sensitive, and anchored to fiat regimes. Ounces are real, unit-independent, and stable across monetary resets.

The coin ladder enables unit flexibility: large units store value, medium units enable transactions, small units handle local emergencies. It is a unit-based monetary gradient optimized for function, not speculation.

Gold is an emergency bridge asset, not a competitor.

Silver

Allocation: 40 ounces of physical silver, held in self-custody.

Breakdown: One-ounce coins only. No bars.

Silver solves a problem gold cannot: denominational usability. Even fractional gold is too coarse for everyday transactions. Silver provides small, intuitive units that map naturally to food, fuel, and short-term services.

Silver is not an investment. It is a transaction tool providing continuity when bank rails fail, digital payments vanish, or fiat credibility collapses while daily life continues.

Units matter more than fiat value. Forty coins represent:

- Forty independent settlement units

- Forty opportunities to transact without institutions

- Forty chances to bridge disruption without touching gold

Silver's utility is non-linear. The first ounces matter far more than later ones. Beyond a threshold, additional silver adds mass, visibility, and cognitive load without improving survival.

Historically, silver is most useful during transition, not permanence:

- Emerges organically for local trade

- Bridges instability

- Recedes once new monetary rails appear

The Survival Floor insures the gap between regimes, not a lifetime barter economy.

This allocation is sized by duration, not fear, assuming temporary payment-system stress and eventual normalization, not permanent collapse.

Summary

The Survival Floor is not a portfolio. It is an anti-ruin system.

Cash buys time.

Gold bridges freezes.

Silver enables local continuity.

Each component is capped deliberately. Excess adds complexity, visibility, and narrative drift without improving survival. This layer exists so nothing else is ever sold under pressure.

Portfolio-Level Properties

Once assembled, the portfolio exhibits properties that do not exist in its components. These are emergent behaviors of the system.

The most important: elimination of forced action under stress. The Survival Floor ensures Bitcoin is not sold at the bottom, decisions are not rushed, and outcomes do not depend on forecasts, institutions, or timing. This alone materially alters long-term results.

As a system, it:

- Maximizes upside across all functional worlds

- Avoids catastrophic illiquidity during stress

- Does not overweight fantasy collapse scenarios

- Minimizes long-term drag from inferior capital

It passes the backpack test: how much value must be portable, institution-free, and immediately usable to survive extended disruption? This constraint forces realism and caps excess.

The portfolio avoids common failure modes:

- Over-allocation to "safe" assets that bleed quietly

- Middle-risk assets that dilute convexity without improving survival

- Diversification for its own sake

- Percentage-only thinking divorced from survival constraints

The portfolio is non-ergodic but less fragile than any individual component. Ergodicity is technically binary, but robustness exists on a gradient. By bounding downside and preventing ruin, the system reduces negative path dependence and increases the probability of long-term participation. This allows asymmetric upside to express itself.

The result is a portfolio that is architecturally sound, operationally simple, psychologically stable, and aligned with non-ergodic reality. It is anti-drift: resistant to slow degradation from emotion, salience, and narrative pressure.

This portfolio is sparse by design. Sparsity is not aesthetic; it is structural. Sparse systems are more robust, easier to maintain, harder to mismanage, and less prone to degradation. Every additional asset, rule, or exception increases cognitive load and introduces new failure modes.

The portfolio has no daily decisions and no "should I adjust this?" loops. Compartments are clear, rules are fixed, behavior under stress is predetermined. This simplicity is what makes the system psychologically stable.

Mental calm is a real asset. By eliminating unnecessary choice, resisting narrative pressure, and removing constant monitoring, the portfolio preserves decision quality and discipline. This is a core system property, not a side benefit.

Entrepreneurship

Entrepreneurship is not an asset class. It is an external engine that converts time, effort, and learning into convex outcomes without risking survival capital.

Unlike financial assets, entrepreneurship compounds skill, distribution, and optionality, not capital alone. Downside is bounded by effort and iteration; upside is fat-tailed. It replenishes and expands the portfolio without requiring asset sales.

Entrepreneurship sits outside both layers by design. It does not jeopardize survival capital or dilute convex exposure. It earns the system back into balance through new income, not reallocation.

Human capital convexity is fundamentally different from financial convexity. It is iterative, antifragile, and resilient across market regimes. Over time, it becomes the dominant source of new optionality and the preferred mechanism for scaling.

The difference between first-order and second-order activities is critical. Building a successful product is first-order. Chasing yield, active trading, volatility strategies, constant analysis: these are second-order. They consume time, attention, and emotional bandwidth while introducing monitoring, micro-decisions, and cognitive noise.

Time, focus, and emotional bandwidth are scarcer than capital. Spending them on options chains, volatility regimes, position management, or yield optimization is almost always dominated by building products, building distribution, and iterating on real leverage.

Entrepreneurship keeps the portfolio sparse, calm, and uncompromised as it scales. It is the mechanism through which growth continues without complexity, fragility, or forced action.

Rebalancing and Scaling

The portfolio is governed by rules, not discretion. Rebalancing is asymmetric: replenishment, not selling.

Core rules:

- Bitcoin is never sold except under critical necessity.

- Excess Convex Upside cash flows into Bitcoin. If below target, replenish with new income. Never rebalance by selling.

- Survival Floor assets are never sold to rebalance. Replenish if needed.

- Survival Floor cash is never invested.

- Bitcoin is never sold to fund the Survival Floor.

- Floor targets increase only for new dependencies, jurisdictions, or obligations.

Replenishment comes from entrepreneurship. Excess Convex Upside cash may be used if required. The invariant: Bitcoin is not sold to rebalance anything.

This structure eliminates forced selling, panic, institutional dependence, and complex decisions. No forecasts, no timing, no ongoing management. Gold and silver shrink in relevance as wealth grows. Bitcoin does not.

The system scales cleanly, quietly, without attention.

Final Notes

This framework is not a rehash of barbell theory, permanent portfolios, or Bitcoin maximalism. It is a systems-level synthesis that treats non-ergodicity, human behavior, and institutional failure as first-class inputs, not edge cases.

Its elegance comes from exclusion as much as inclusion. Constraints are chosen to preserve calm under stress. The result is a portfolio that is coherent, sparse, and resilient by design, not optimization.

Every asset category was considered. Those excluded were excluded deliberately. Every addition increases system complexity, invites tinkering, and dilutes convex exposure.

Long-term structural convexity does not require constant action. It does not decay if you do nothing. It scales with patience, survives adverse paths, and rewards discipline.

The hardest part is not building the portfolio, but leaving it alone.

Version 1.0 – January 13th, 2026

Not financial advice.

Contact: www.thecraiganthony.com · X/Twitter